ISLAMABAD: The National Assembly approved the government’s tax-heavy finance bill for the upcoming fiscal year on Friday, just before engaging in further talks with the International Monetary Fund (IMF) to secure a new bailout and avoid a debt default. This comes at a time when Pakistan’s economy is growing at the slowest pace in South Asia.

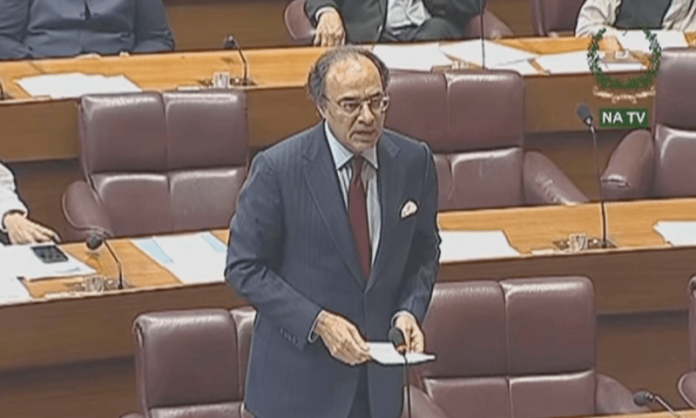

The budget, introduced two weeks ago, has faced significant criticism from opposition parties, especially the Pakistan Tehreek-e-Insaf (PTI) and coalition ally Pakistan Peoples Party (PPP). Finance Minister Muhammad Aurangzeb presented the bill in the National Assembly, with Prime Minister Shehbaz Sharif’s endorsement.

Opposition parties, particularly those supporting the imprisoned former premier Imran Khan, have rejected the budget, arguing that it will lead to high inflation. Initially boycotting the debate, the PPP eventually decided to support the bill despite reservations. PPP leader Naveed Qamar stated that voting against the budget would destabilize the government and the country. He assured that the government had the necessary votes to pass the budget.

Members of the Muttahida Qaumi Movement-Pakistan (MQM-P), another coalition partner, also expressed concerns about the new taxes on salaried and middle-class individuals, warning of increased inflation.

NA Speaker Sardar Ayaz Sadiq announced the bill’s passage during a live TV broadcast.

The new budget sets a challenging tax revenue target of Rs13 trillion for the fiscal year starting July 1, an increase of about 40% from the current year. This target aims to strengthen Pakistan’s case for a new IMF loan of $6 billion to $8 billion. The rise includes a 48% increase in direct taxes and a 35% increase in indirect taxes, alongside a 64% boost in non-tax revenue, including petroleum levies.

The budget also raises the tax on textile and leather products, mobile phones, and capital gains from real estate. Workers will face higher direct income taxes. The government projects a decrease in the fiscal deficit to 5.9% of GDP for the new financial year, down from 7.4% this year.

The central bank has warned of potential inflationary effects due to limited progress in broadening the tax base, necessitating higher taxes. The growth target for the upcoming year is set at 3.6%, with inflation projected at 12%.